How Economic, Political and Social Factors Correlate with Conditions of IPOs

How do the above mentioned factors affect the IPO market. Examples of negative effects and positive effects.

This paper studies the impact of economic, social and political factors on the IPO markets. IPO or Initial public offering is the official stock market launch of a company in which the company offers shares or sells stock to both institutional and retail investors. Social factors such as social unrest or natural disasters, political factors such as elections, change of leadership, policies and conflicts can affect the IPO market (Gregoriou 121). Economic factors such as recession, high unemployment or economic downturn can all negatively impact the IPO markets.

Increase / Decrease in Number of IPOs

The number of IPOs tend to increase when market conditions are favorable. Changes in government policies, leadership or political elections, market structure, investor and consumer demand, proven or unproven business models, and intense competition among companies are some factors (Goetzmann, Rouwenhorst, Geert. 87). These factors can reduce or increase the number of IPOs at a specific time. Public markets are often seen as gateway to capital formation and creation of jobs, further boosting the economy. However, regulatory factors may deter companies from going public and too much regulation would mean a decrease in the number of IPOs. Availability of capital in the early stages, such as from Venture Capitalists or Angel Investors tend to encourage startups to go public as an exit strategy. However investor protection rules and other legal and regulatory requirements are important factors that may deter companies from leaping into IPO markets too quickly. The US IPO market was particularly significant in the 1990s when more general public became engaged in buying and selling of stocks. Typical post IPO returns are meager for investors, and most startups do not make it to the IPO and fail within the first five years. This failure of startups may explain the increase or increase of IPO markets during specific periods. Lack of funding from VCs and other investors during the startup phase, affects the ability of companies to go public. The two-tier regulatory structure also gives different levels of legal or governmental protections to big and small companies (CFO 2017). When the market looks primed for higher growth and there is a more positive direction to the economy, there may be an increase in the number of IPOs. Political instability, war, terrorism, natural hazards tend to decrease the appetite for IPOs as markets look bleak during these times.

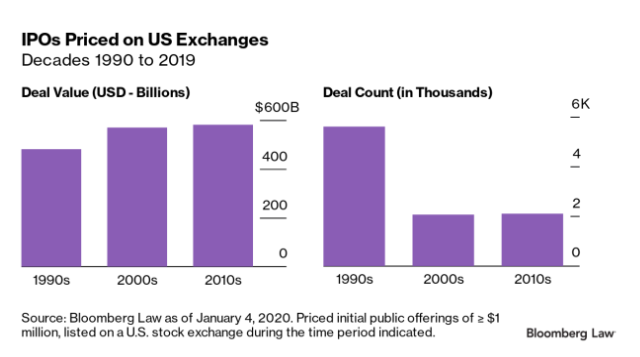

The graph below shows the trends in increase or decrease of IPO numbers. 675 or highest number of IPOs seen in 1996, which reduced to just 41 in 2009. In the 1990s, there was an explosion in the number of companies filing for IPO. That trend has not returned since. Number of IPOs in recent years was highest in 2014 at 275 but decline rapidly to 105 in 2018. IPO proceeds in billions went down from $85 billion in 2014 to $28 billion in 2018 (Statista 2020). Bloomberg law writes that the 90s saw more than 5000 IPOs in 10 years due to the dot com boom.

Increase / Decrease in Size / Value of IPOs

The chances of IPO success of a company depend on the attractiveness of the equity offered to investors. However, there are sociopolitical, economic and legal factors that also play an outsized role in IPO success and valuation of companies. The economic conditions of the IPO launch can relate to certain internal factors such as the attractive equity, right price of shares (the price at which investors are willing to buy and sell the shares), appropriate valuation or positioning of the company alongside other companies in the same sector, providing a reference point for prediction or analysis, organization of the roadshow and outreach to potential investors, offering right size and structure of the company's goals and execution, as well as the strategy adopted in allocation of shares (Gregoriou 103).

Among the economic factors that affect IPO success, the right market timing can provide insights and opportunities on the possibility of success if other issues such as market trends, competing transactions or market competition in general and potential threats of recession or other negative factors are considered (Goetzmann, Rouwenhorst, Geert. 134). The size and value of IPO would also depend on investor analysis of similar companies, as well as on the analysis of market trends, consumer demands, and valuation of companies in the same sector or with similar products. Competition and demand are often weighed to understand the overall performance of the company as expected in the future and whether the company can scale and reach a size that would make it attractive to investors. Market standards and the share liquidity would also affect the overall IPO success of a company.

The graph below by Bloomberg law shows the value of IPOs over three decades. (Bloomberglaw)

Increase / Decrease in Volatility of Markets / Stocks / Any Traded Securities

Volatility is defined as dispersion around the average return of a traded security. Increase or decrease in volatility can be related to national economic factors, such as economic policies, tax or interest rate policies, market trends and directional change. Change in interest rates can lead to stock market reactions. Changes in inflation trends as well as political factors such as elections or other events can have an impact on volatility. Long term stock market trends and analysis can also affect market conditions. Environmental conditions like hurricane, storm or hazards such as wildfires, earthquakes can trigger increased oil prices and create volatility in oil related stocks. The stock market could become suddenly volatile as have seen during major global events (the ongoing 2020 pandemic), in which the Dow Jones Industrial Average, S&P 500 have shown extreme volatility with significant investment risks, although fir some investors, when markets crash or are rattled, they find it as the right opportunity for investment.

These market trends have to be corrected harnessed. Social factors such as high unemployment, sudden shifts in trade or economic policies, stimulus payments, interest rate cuts, possibility of long-term recessions, company bankruptcies, new technologies or inventions, immigrations, job cuts and even government announcements or policy shifts can create extreme market changes or volatility (CFO 2017).

It's worth noting that volatility in the financial markets is often welcome by the corporate financial and trading institutions because during these times they can make money. These institutions develop various trading strategies, from moving averages and momentum indicators to price action and Elliott Wave theory (Price Action Help).

Reasoning for Correlation

The correlation of these social and political factors with data on IPO markets suggests that social, political, environmental and economic factors correlate significantly with size, valuation, number of IPOs as also the market trends and market volatility in a specified period of time (CFO 2017). The correlations are however expected as high market volatility or extreme shifts, as also number of IPOs can predict the market behaviour and also indicate problems or underlying factors that drive the economy. The risks inherent in the market can be predicted through the behavior of stocks, trends and company valuation during IPOs (Gregoriou 147). Overvalued companies losing valuation during IPOs (as recently happened with WeWork), might suggest an approaching bubble if other companies are also overvalued and show a overvaluation trend. High IPO expectations can be as bad as low expectations, that will see almost no investor interest. A healthy profitable company with significant investor interest can create optimism and an upbeat investor outlook. Thus, a correlation between internal factors within a company affecting size and value and the success of the IPO is as significant as the correlation between external factors such as policies, economy, politics, recession, hazards, market conditions and success of an IPO.

Works Cited

Bloomberg Law. ANALYSIS: Three Decades of IPO Deals (1990-2019). BloombergLaw.

CFO. Many Factors Influence the Market for IPOs. From CFO.

Essay Coupons. Corporate Sponsorship and Public Schools: A Critical Inquiry. essaycoupons.com/research/corporate-public-schools/

Goetzmann, William N.; Rouwenhorst, K. Geert. The Origins of Value: The Financial Innovations that Created Modern Capital Markets. Oxford University Press. 2005.

Gregoriou, Greg. Initial Public Offerings (IPOs). Butterworth-Heineman, an imprint of Elsevier.2006.

Price Action Help. Price action analysis, trading strategy, the Elliott Wave principle, and financial forecasts of stocks, commodities, currencies, and crypto. From PriceActionHelp.com

Statista. Statistics on Initial Public Offering in the United States. 2020.